self employment tax deferral due date

Individuals can pay the deferred amount any time on or before the due date one-half by December 31 2021 and the. Like the FICA tax half of the deferred Self-Employment Tax is due January 3 2022 and the remainder is due January 3 2023.

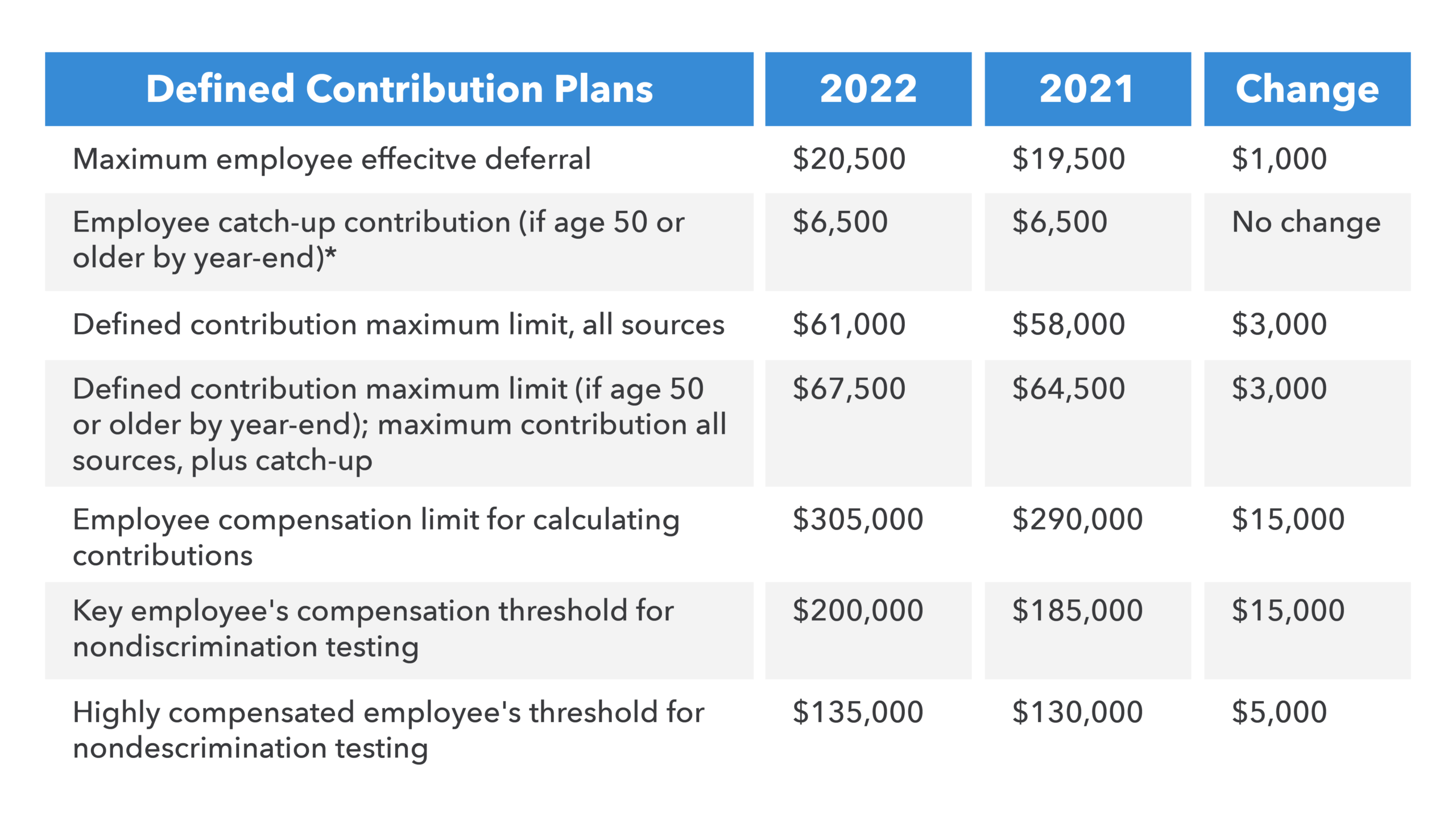

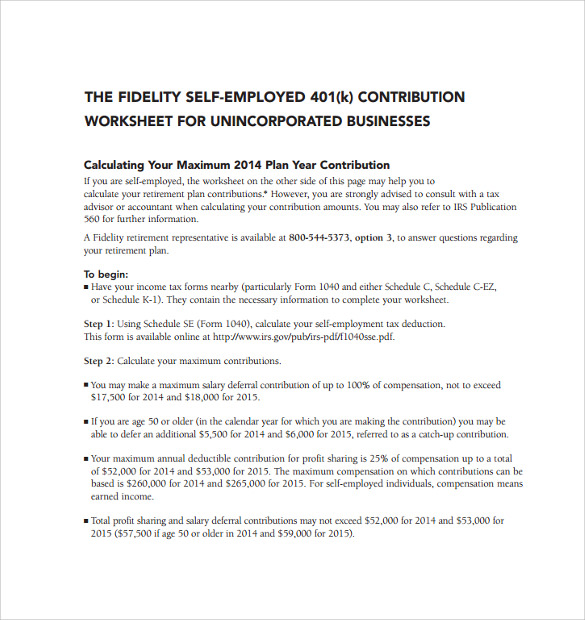

How Much Can I Contribute To My Self Employed 401k Plan

This means that self-employed individuals that defer payment of 50 percent of Social Security tax on their net earnings from self-employment attributable to the period.

. The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040. In particular the law allows self-employed individuals to defer the employer portion of Social Security payroll tax payments that would usually be due from March 27 2020 to. The deferred amount must be deposited by the following dates referred to as the applicable dates to be treated as timely and avoid a failure to deposit penalty.

December 31 2021 50 of the deferred amount December 31 2022. In particular the law allows self-employed individuals to defer the employer portion of Social Security payroll tax payments that would usually be due from March 27 2020 to. The payroll tax deferral period began on March 27 2020 and ended on December 31 2020.

WASHINGTON The Internal Revenue Service today reminded employers and self-employed individuals that chose to defer paying part of their 2020 Social Security tax obligation. Thanks to passed legislation self-employed individuals were allowed to defer 50 of their Social Security tax portion of self-employment tax from March 27 2020 December 31. These FAQs address specific issues related to the deferral of deposit and payment of these employment.

According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code on net. The tax rate for Social Security is 62 for employers and 62 for employees. How do I make deferred self-employment tax payments.

Friday June 10 2022Edit. Self-employed taxpayers could defer 50 percent of their income earned between March 27 2020 and December 31 2020. For taxes deferred in 2020 the repayment period for self-employed individuals and employers is.

Self employment tax deferral due date. Deferred taxes are paid in two installments. Employers who make their own payroll tax deposits will.

If that first installment wasnt paid by 123121 - the entire deferral became due with penalties interest all the way back to 51521 I think that was the original due date for. Self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code on net earnings from.

Paying Self Employment Taxes On The Revised Schedule Se Don T Mess With Taxes

Payroll Tax Deferral Deposits Due By Jan 3 2022 Baker Tilly

2021 Federal Tax Deadlines For Your Small Business

How To Defer Your 2020 Tax Payments Bench Accounting

Employee Social Security Tax Deferral Guidance Too Little Too Late

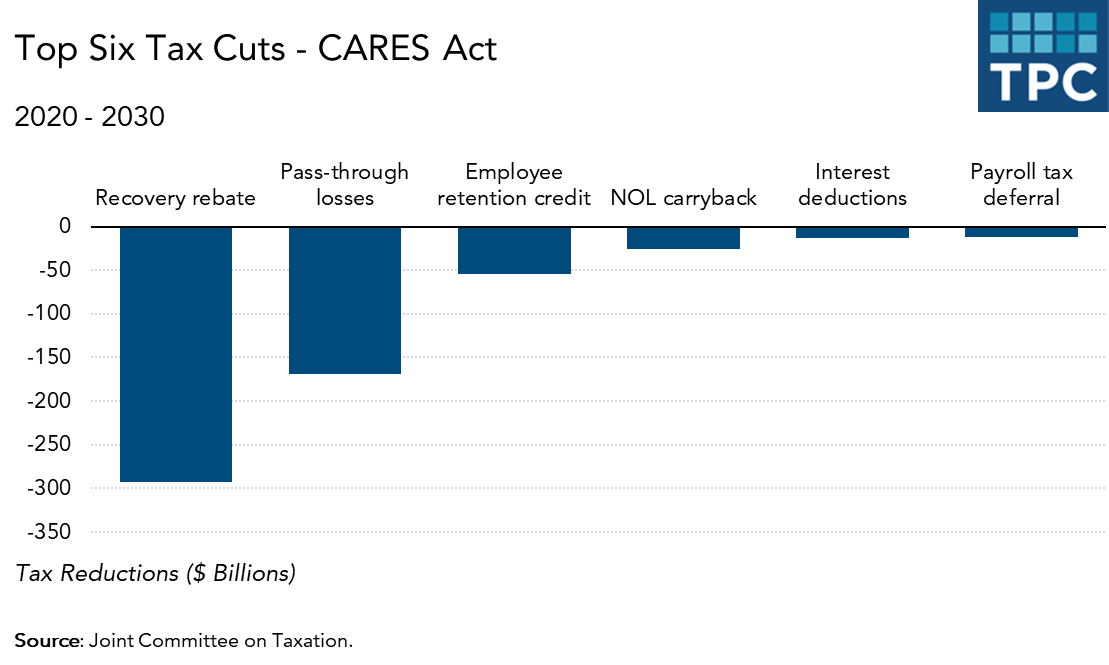

Who Benefits From The Cares Act Tax Cuts Tax Policy Center

How Do You Opt Out Of Self Employment Tax Deferral Intuit Accountants Community

Deferred Se Tax Payments R Taxpros

Maximum Deferral Of Self Employment Tax Payments

2022 Tax Calendar Important Tax Due Dates And Deadlines Kiplinger

Payroll Tax Deferral Extension Deadlines And Responsibilities Rosenblatt Law Firm

Maximum Deferral Of Self Employment Tax Payments

Cares Act Payroll Tax Deferral For Employers

What The Self Employed Tax Deferral Means Taxact Blog

Free 6 Sample Self Employment Tax Forms In Pdf

Investmentnews December 14 2020 Page 16

Making Year 2021 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Backdoor My Solo 401k Financial

How To Calculate Payroll Taxes Tips For Small Business Owners Article